The Austin housing market is showing noticeable signs of cooling as inventory levels reach an 8-year high. This shift comes as rising mortgage interest rates, currently around 8%, dampen buyer demand. According to the latest MLS data collected, Austin’s median home price is essentially unchanged from last year to $574,500. While still historically high, this marks a 15-20% drop from the $680,000 peak in 2022.

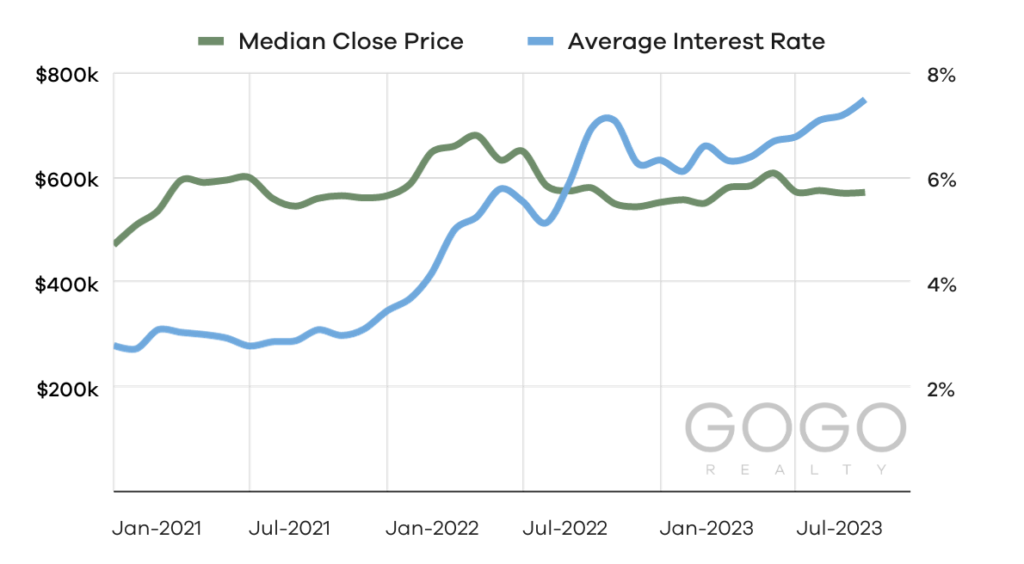

As the below graph indicates, prices have stabilized in recent months even as rates continue climbing. Prices saw rapid acceleration during 2021, peaking in May 2022 before declining during the second half of 2022 and leveling off in 2023.

Meanwhile, interest rates remained low, under 3%, for most of 2021 before sharply rising throughout 2022 and 2023 in response to robust economic and inflation data. This graph shows strong home price appreciation in Austin in spite of rising rates, though prices are moderating as rates continue to climb.

The added inventory is good news for buyers who faced ultra-competitive, bidding war conditions in recent years. More selection provides increased opportunity to find homes at lower price points compared to 2021/2022’s frenzy. However, on the flip-side, higher interest rates have reduced buyer purchasing power. Motivated sellers are often paying for rate buy-downs to temporarily off-set higher interest rates.

For sellers, this normalization requires pricing strategically to attract buyers. This shift toward more of a buyer’s market allows for more negotiation on price and terms for both parties. While economic strength continues to put upward pressure on rates, the higher costs have clearly cooled demand.

The Austin market remains strong with incredible job growth and migration, but the housing slowdown does provide advantages for both buyers and sellers who understand the dynamics. Don’t hesitate to contact me if you’re thinking of making a move. My expertise and insights can help you capitalize on today’s shifting market.